Front-of-meter storage

The energy transition will drive tremendous needs for flexibility in the power system. Stationary battery parks can contribute through:

- Time shifting renewables and/or demand to keep the system adequate;

- Compensating for unplanned outages and for forecast deviations of the renewable production and/or the electricity demand in order to keep the system balanced and avoid frequency deviations;

- Contain frequency drops/surges when such balance cannot be maintained.

Currently, balancing of the power system mainly relies on thermal (gas) plants operating at partial load so they can produce less or more in function of the anticipated or observed mismatches between power injections and off-take.

With the further development of renewables, periods within those thermal plants are “in the money” (marginal generation price < spot price) will be ever shorter and less frequent. Relying on such plants to balance the system will be increasingly expensive, since the required “missing” money to keep these plants operating will be ever higher.

In order to mitigate the increase of the cost for system balancing, it is therefore essential to develop battery parks capable of offering an alternative to such “spinning reserves”. Without such alternatives, even in periods when renewables can fully offset the demand, thermal plants should always be kept operating to deliver balancing reserves, making it impossible to reach our (net) zero emission targets.

But the benefits and cost saving potential offered by batteries to the power system go even further:

- batteries can avoid situations whereby the system would have to structurally rely on paying production units for not producing (curtailment of renewables) or (industrial) consumers for not consuming (load shedding) to keep the system adequate and stable;

- batteries can store renewable energy production excess for later re-injection, offering an alternative to gas peakers that is more sustainable from an environmental and an economic perspective (decreasing operating hours from gas peakers along with the development of renewables will disrupt their business model).

The value that can be generated from battery storage to the grid and the electricity market by delivering adequacy and/or flexibility services can be significant, but establishing a viable and most of all bankable business model remains tricky as such value is hard to capture and highly volatile in nature.

This is where BSTOR’s expertise comes into play. As demonstrated through the ESTOR-LUX 10MW/20MWh battery park in Bastogne, our added value resides in the sourcing, structuring and contracting of the project earnings in a way that incentivises optimal usage of the asset over its whole lifetime and generates sound and forecastable cash flows.

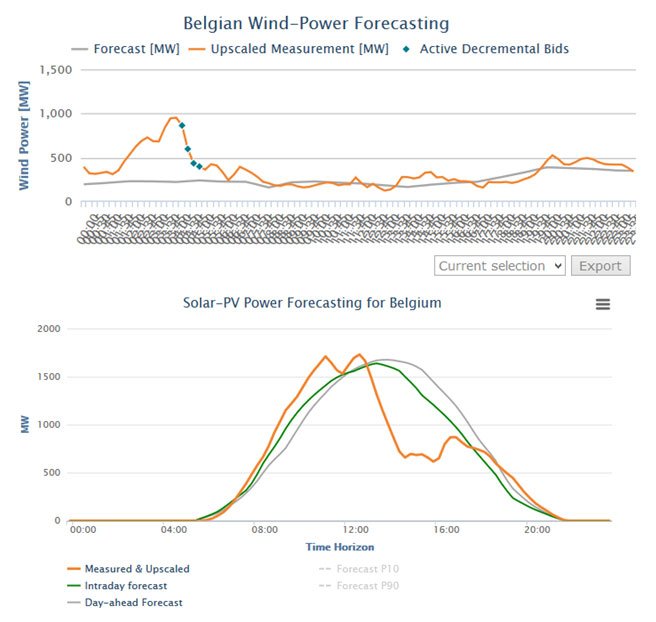

Example of typical forecast error events that can be compensated by a battery park. The unexpected additional wind generation in the morning (of the first graph) can be stored and injected in the afternoon when the solar output is lower than in the day-ahead (and even the last intraday) forecast.